Reflecting on Lower Carbon Fuels in 2021 and Looking Ahead to 2022

Last year, we wrote about what to expect for lower carbon fuels in 2021. Let’s see how much of it came true and what we think will happen in the new year.

We said: Diesel engines aren’t dead

This holds true, but not without some challenges. Heavy-duty truck sales are coming back slowly as OEMs struggle to deliver due to shortages and supply chain bottlenecks.1 This means fleets are keeping trucks longer and used truck sales are very high, so using a fuel that supports longer life and better performance is key.

Electric truck sales have faced similar supply issues due to the pandemic,2 and charging infrastructure is simply not ready yet. It’s expected that light-duty trucks (shorter routes) will make up most of this segment, as charging capacity isn’t where it needs to be for medium- and heavy-duty.3

We said: Biodiesel’s star is rising and it’s getting used in new ways.

This is truer than ever, as biodiesel is still far ahead of electric on carbon intensity reduction. The California Air Resources Board (CARB) uses a “well to wheels” approach to calculate CI scores, considering both the direct effects (like fuel production and usage) and indirect effects (like land use) that a fuel has on the environment. The lower the score, the better. Biodiesel’s CI score as of Q2 2021 is about 28, whereas electric sits at about 83.4

Work truck fleets list biodiesel as their top alternative fuel choice year after year over other options like EVs and CNG vehicles, according to annual surveys by NTEA. Many states incentivize or even require the use of biodiesel blends now, from a minimum of B5 on up to higher blends. And most OEMs now allow for and even promote the use of up to B20.

The main reason higher blends have not taken hold quite yet is a lack of regulatory incentives and pricing,5 but the Higher Blends Infrastructure Incentive Program (backed by the Department of Agriculture) is working on this and seeing some success for both biodiesel and ethanol.

The recently passed federal Infrastructure Bill highlights biodiesel’s viability as well: Grant programs established by the Infrastructure Investment and Jobs Act encourage investments in a range of alternative fuels, including electricity, hydrogen, biofuels and natural gas.6

We said: GHGs will remain a hot topic.

Greenhouse gases are still in the spotlight and will probably stay there for quite a while. The transportation sector is responsible for 29% of all U.S. GHGs, with trucking making up the majority of that. Existing environmental regulations significantly reduce particulate and NOx emissions but do little to reduce GHG emissions, so there is more work to do.

Improved engine efficiency and alternative fuels will be the most significant factors within the freight transportation sector to contribute to a lower carbon future.7

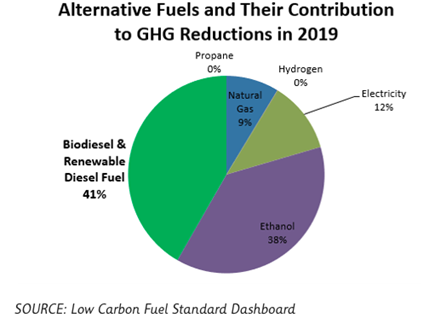

Biodiesel and renewable diesel are supporting measurable reductions in greenhouse gas emissions in the transportation sector. In California, these benefits nearly quadruple those from the electrification of cars, trucks and buses (see chart).8

We said: The ESG movement is just getting started

Environmental, social and governance (ESG) accountability has definitely made its mark on the transportation industry.

“We see a lot of very large fleets paying particular attention to environmental and social governance in regard to reducing emissions. I also see a lot of companies are now starting to focus on electric,” says Al Barner, senior vice president of business development at Fleet Advantage. “However, we see that there will be a runway for diesel for many years to come.”9

In fact, ESG funds are on track for a record year of inflows, bringing in more than $21 billion in the first quarter of 2021. That’s an acceleration from 2020, when they earned more than $51 billion for the year; 2019, when they realized $21.4 billion; and 2018, when they saw about $5.4 billion in inflows.10

Yahoo! Finance notes that more legislation will encourage further development in lower carbon investments, pointing to various amendments and acts that push advisors to convey ESG-related factors to investors. By 2025, approximately 33% of all global assets under management (not just domestic) are forecast to have ESG mandates. The industry is expected to increase 433% between 2018 and 2036, resulting in total global assets of $160 trillion.

In total, 132 countries around the world have enacted some type of policy to be carbon neutral by 2050. Additional legislation and consciousness about reducing carbon intensity will further heighten the opportunities and demand for sustainable investment opportunities.11

So, with those updates in mind, here are some predictions for 2022:

We think: Pressure will continue mounting for emissions reduction

CARB estimates that in 2020, almost 7 million tons of GHG emissions were eliminated by switching from petroleum diesel to biodiesel and renewable diesel. This is equivalent to the annual mileage of 1.5 million passenger vehicles.12

That success will need to continue because the Biden administration has set a goal to cut U.S. GHG emissions by 50% to 52% by 2030 (from where they were in 2005). This target lines up with scientific assessments of the reductions needed to avoid the worst impacts of climate change. A 50% cut isn't the world's most aggressive target, but it puts the U.S. among the four most ambitious countries (behind the United Kingdom, European Union and Switzerland).13

Currently, 34 states have released or are in the process of developing a climate action plan of their own. Twenty-four states and the District of Columbia have established GHG emissions targets.14

We think: People are beginning to understand that immediate action is required

It seems the transportation sector is really catching on to the fact that we can’t wait for the perfect single solution to improve emissions. A recent study showed that 91% of fleet leaders feel significant pressure to work toward lower carbon targets..

Luckily, there are several ways to do that, and some fleets are leading the way. For example, the adoption of technology that allows trucks to run on B100 is going well for several fleets, even in colder temperatures.

The San Francisco Municipal Transportation Authority has been using renewable diesel in its fleet of more than 600 buses to reduce carbon dioxide emissions by an estimated 10,000 tons. And Florida Power and Light now uses biodiesel in its fleet of more than 3,900 utility vehicles to help reduce carbon dioxide emissions by around 6,700 tons.15

Renewable Diesel/Biodiesel Blend, our proprietary blend of biodiesel and renewable diesel, is now available at 18 cardlock sites in California and Illinois thanks to a partnership with fuel distributor Hunt & Sons. We look forward to the expansion of this blend’s reach as we increase our renewable diesel capacity.

To join the aforementioned organizations and fleets in working toward a lower carbon future, consider an integrated energy management approach. And don’t be afraid to contact your local, state and congressional reps to let them know why lower carbon fuels and the resulting carbon emissions reductions — are something we can’t wait for.

1 Trucks, Parts and Service

2 Supply Chain Dive

3 Allied Market Research

4 CARB and CARB

5 Department of Energy

6 Commercial Carrier Journal

7 Department of Transportation

8 Diesel Technology Forum

9 Fleet Equipment

10 CNBC

11 Yahoo! Finance

12 Diesel Technology Forum

13 NPR

14 Center for Climate and Energy Solutions

15 Diesel Technology Forum